In the global economy, rising tariffs are making the U.S. ski industry’s reliance on outsourced goods and services an expensive reality.

No matter how much time you spend on the skintrack, it’s hard to escape the news these days. And there’s no way to escape rising costs. Since taking office in January 2025, President Trump has imposed a slew of tariffs on imported goods. Regardless of intentions or exact numbers, the impact is the same: In today’s economy, the U.S. is dependent on a global supply chain, and higher tariffs equal a more expensive manufacturing process. In many cases—including the ski industry—this has led to increasing prices.

Take that lightweight paulownia core favored in touring ski construction. Paulownia trees primarily grow in China, so chances are, the wood was imported. It’s now subject to a total 55% tariff (25% as of 2018 plus an additional 30% as of May 2025). Or that Gore-Tex jacket sewn in a Chinese factory. Prior to 2025, it would already have invoked a 35.5% tariff, now it’s 65.5% (as of August 2025).

While large companies with a worldwide presence may be insulated by diversified markets, smaller-scale, U.S.-centric brands are not. It’s why Cassie Abel, founder of the Idaho-based, women’s-specific outdoor apparel label Wild Rye, has been so outspoken about the impact of rising tariffs. When the brand originally launched in 2016, they tried to manufacture domestically. “It almost sank us before we came to market,” says Abel. So, they looked elsewhere. “The only country that could take the majority of our product and produce really high-quality product at a lower minimum order quantity was China.”

Now, increasing tariffs are costing Wild Rye an unhealthy amount. “I would say $200,000 were invested into solving this problem within a month and a half between women-hours and hard costs,” Abel says of their efforts to calculate the impacts and outcomes of fluctuating duties. That’s about 5% of Wild Rye’s revenue. It might not sound like a lot, but the consequences are real. “We’re having to cut our PR agency, not hiring to replace employees who leave—it’s at the cost of innovation,” she says. To address the challenges they’re facing, Abel started an equity crowdfunding campaign, selling shares of her company to raise money that they need now. Retail prices will also increase—10% for Fall ’25 and closer to 15% for 2026.

Apparel, which comes out seasonally and is made on a shorter turnaround, frequently by outsourced labor, is experiencing immediate impacts. Ski manufacturing, however, occurs on a longer time- line, often with materials being ordered well in advance of when skis go on sale.

Brands like Voilé and DPS, who construct their boards and skis in Salt Lake City, have yet to feel direct hits. Both ordered supplies for this year’s ski line before the 2025 tariffs were imposed. “We’re kind of holding the line on our prices in hopes that we’ll return to some normalcy,” says Voilé ski and board production coordinator Adam Morrey.

What Morrey is more immediately worried about is trade with Canada. On August 1, 2025, Trump raised tariffs on many Canadian goods to 35%. In response, Canada imposed the same on the U.S. “We don’t buy a lot of materials from Canada, but we certainly do a lot of business with Canada,” he explains. “We export our skis to Canada.”

And then there’s the fact that tariffs come on the heels of a very rough economic spell for outdoor industry brands post-COVID. “Marketwise, it’s tough,” Morrey says. “There were plenty of businesses going under before the tariffs and so, honestly, right now, you can find cheap skis, it’s flooded.”

It’s a widely felt sentiment. “We’d all just recovered,” says Abel of weathering the COVID storm. Now, tariffs are a costly kick in the teeth.

Based on the last eight months, it’s hard to say where tariff numbers will land by the time this issue hits newsstands in October, let alone where they’ll be next year. Or prices for that matter. Still, the reality of tariffs remains: The only way to avoid them is to use foreign goods and services as little as possible.

DPS shifted to a domestic supply chain and manufacturing process back in 2020 to reduce their skis’ carbon footprint. As DPS Senior Vice President Thomas Laakso explains, for them, the impacts of tariffs will be experienced indirectly through their suppliers and likely at a lag. But he warns that transitioning to American-made isn’t a simple task.

“This whole build domestic thing—that’s what we’re doing and that’s what we’ve been doing, and we’re here to say—it’s not easy,” Laakso admits.

Even for ski companies like DPS that have made the jump, it’s a pricey investment. And for industries like apparel, the infrastructure to manufacture independently of the global supply chain simply doesn’t exist yet. The bottom line is, avoiding tariffs is nearly impossible, and in the face of such an abrupt transition, the cost of that reality is being paid by brands and consumers.

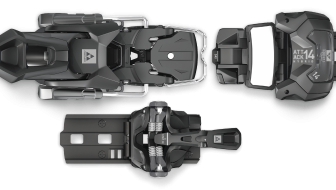

Get the 2026 Gear Guide

After months of testing—including our weeklong Powder Mountain test and tours across North America—our editors narrowed down hundreds of products into the best skis, splits, boots, bindings and outerwear.

Get your copy today👇 | Learn more »

Related posts: